Mastering the Art of Payment Requests: How to Write Effective Emails for Debt Collection in Australia

In today’s fast-paced business world, effective communication is the key to success. This is especially true for debt collection, where a well-crafted email can significantly impact recovery rates.

“Late payments are a persistent problem in Australia, with a significant impact on businesses of all sizes. According to a report by Xero, nearly half of all invoices owed to small businesses in 2023 were paid late, costing these businesses a staggering $1.1 billion annually. You can improve your collection efforts, reduce late payment instances, and maintain positive relationships with your clients by improving the efficacy of your payment request emails.

Email is a powerful tool for reaching out to debtors. It allows you to communicate professionally, provide clear instructions, and track responses effectively. Following this guide’s tips, you can create compelling payment request emails that drive results.

Remember, the goal is to encourage debtors to act while maintaining a professional and respectful tone. In this article, we discuss the best ways to write a persuasive debt collection email for your business. We have already written more tips to help you get your invoices paid on time as a small business.

Crafting the Perfect Subject Line: The Key to Effective Debt Collection Emails

In the world of debt collection, a well-crafted subject line can make all the difference. It’s your first opportunity to grab the recipient’s attention and entice them to open your email. A clear and concise subject line can significantly increase your chances of getting a response and recovering the outstanding debt.

Remember, your subject line should be:

- Clear and Concise: Avoid jargon or overly complex language.

- Action-Oriented: Prompt the recipient to take action (e.g., “Pay Overdue Invoice Now”).

- Relevant: Directly related to the purpose of your email (i.e., collecting an outstanding debt).

Here are some examples of effective subject lines for debt collection emails:

- “Urgent: Overdue Invoice #[Invoice Number] – Immediate Payment Required”

- “[Client Name], Kindly Settle Outstanding Invoice [Invoice Number]”

- “Reminder: Payment Due for Invoice #[Invoice Number] – [Due Date]”

Personalising Your Email for Effective Debt Collection

Personalisation is key to building relationships and driving results in today’s digital age. In the realm of debt collection, personalised emails can significantly improve your chances of recovering outstanding debts.

Addressing Debtors by Name is a simple yet effective way to personalise your emails is to address the debtor by their name. This shows that you’re not sending a generic message but rather acknowledging them as an individual.

Tailor Content to the Situation – Customise your email content based on the specific circumstances of the debt. For example, if you’re following up on a previous payment reminder, reference the earlier communication to show that you’re tracking the situation.

Acknowledge Previous Communication – If you’ve had previous interactions with the debtor, acknowledge those conversations in your email. This demonstrates that you value their input and are actively working to resolve the issue.

Consider Cultural Nuances – When dealing with debtors from different cultural backgrounds, be mindful of cultural nuances and communication styles. Avoid using overly familiar language or making assumptions that might be offensive.

Show Empathy – While being firm in your request for payment is important, a touch of empathy can go a long way. Acknowledge your debtor’s challenges and express your willingness to work with them to find a solution.

By personalising your payment request emails, you’ll create a more positive and engaging experience for the debtor, which can increase the likelihood of payment. Remember, a friendly and understanding approach can go a long way in building trust and fostering a positive relationship.

Clear and Concise Body Content is the Aim of Your Payment Request

Once you’ve captured the recipient’s attention with a strong subject line, it’s time to craft a compelling email body that clearly conveys your message. Here’s what you need to include:

- Open with a Personal Greeting: Begin your email by addressing the debtor by name. This shows that you’re not sending a generic message but rather acknowledging them as individuals.

- State the Purpose Clearly: The email should clearly state that it is a reminder regarding an overdue invoice. Avoid beating around the bush and get straight to the point.

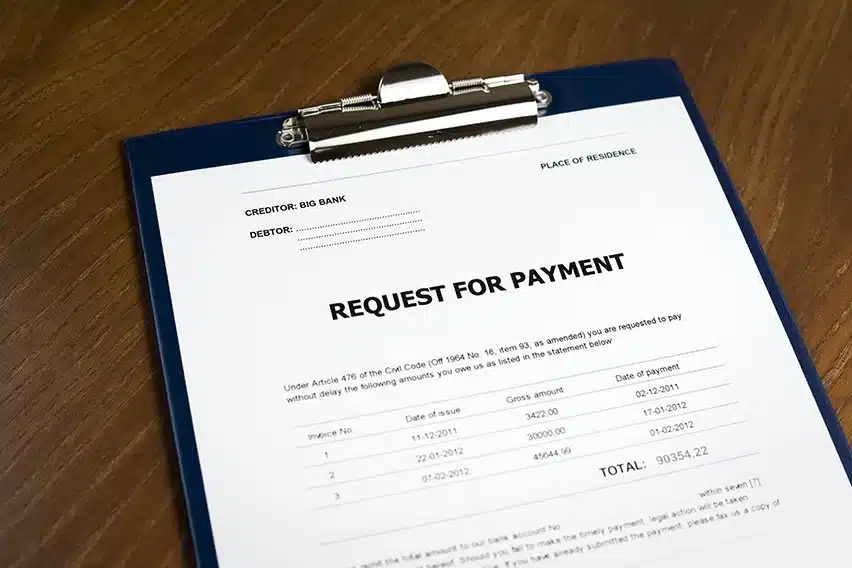

- Provide Specific Details: Include the invoice number, the outstanding amount, and the due date. This information should be easy to find and understand.

- Offer Payment Options: Clearly outline the available payment methods, such as bank transfer, BPAY, or online payment portals. Provide detailed instructions for each method to ensure the debtor can easily make the payment.

- Mention Late Fees and Penalties: If applicable, remind the debtor of any late fees or penalties that may be incurred if the payment is not made by the due date. However, be mindful of your language and avoid sounding threatening or aggressive.

- Include a Call to Action: Encourage the debtor to take immediate action by making the payment. Provide a clear deadline and emphasise the importance of timely payment.

- Offer Help: If the debtor faces financial difficulties, offer to discuss payment arrangements or explore alternative solutions. Show that you’re willing to work with them to find a mutually beneficial resolution.

- To further enhance your debt collection efforts, you might consider incorporating a secure online payment link directly in your email. This provides a convenient and efficient way for debtors to make payments. For those facing financial challenges, you may also want to mention resources available to help them manage their debt. By offering these additional options, you demonstrate your understanding of their situation and your commitment to finding a mutually beneficial solution.

Remember to keep your email concise and to the point. Avoid using overly complex language or jargon that may confuse the debtor. The goal is to make it easy for them to understand the situation and take the necessary action.

A Powerful Call to Action Drives Results in Your Debt Collection Emails

Once you’ve crafted a compelling email body, it’s time to close with a strong call to action. This is your opportunity to encourage the debtor to take the desired action: make a payment.

Here are some tips for writing an effective call to action:

- Be Direct and Clear: Use strong language that prompts the debtor to act immediately. For example, “Please make payment by [date]” or “Settle your account today.”

- Provide Options: Offer multiple ways for the debtor to contact you or make a payment. This shows that you’re flexible and accommodating.

- Create a Sense of Urgency: Emphasise the importance of timely payment by highlighting any late fees or penalties that may apply.

- Offer Incentives (if applicable): Consider offering a small discount or incentive for early payment to encourage prompt action.

Here’s an example of a strong call to action:

“To avoid further action, please make payment by [date]. If you’re unable to pay in full, please contact us to discuss alternative payment arrangements. We’re here to help you find a solution that works for both of us.”

Using a persuasive call to action can increase the likelihood of the debtor taking the desired action and ultimately recovering the outstanding debt.

Additional Tips for Crafting Effective Payment Request Emails

Attention to Detail is important. Proofread carefully and ensure your email is free of errors in spelling, grammar, and punctuation. A well-written email reflects your business and attention to detail. Consistent Branding also helps. Use your company’s branding elements, such as your logo and colours, to create a cohesive and professional look.

Follow-up strategies would include scheduling reminders by setting up automated reminders to follow up on emails that don’t receive a response within a specific timeframe. You should also be persistent but respectful in your follow-up efforts. Don’t give up easily, as multiple attempts may be necessary to collect the debt.

Tracking and Analysis can also help improve your debt recovery efforts. Use email tracking tools to monitor your email open rates and click-through rates. This data can help you measure the effectiveness of your emails. Be careful to study the responses you receive to identify trends and areas for improvement.

By following these tips and incorporating best practices, you can craft effective payment request emails that increase your chances of recovering outstanding debts. Remember, the key to successful debt collection is a combination of persistence, professionalism, and effective communication.

At Bell Mercantile, we specialise in debt collection strategies that deliver results. Our experienced team can help you craft compelling emails and remove many of the complexities of debt recovery in Australia. Contact us today to learn more about our services we are just a quick and friendly call away +61 3 9596 9311

FAQS

What are the common mistakes to avoid in debt collection emails

Common mistakes include using aggressive language, failing to personalise the email, neglecting to provide clear payment instructions, and not following up on previous communications. Avoiding these pitfalls can improve your chances of successful debt recovery.

How can I track the effectiveness of my debt collection emails

You can track effectiveness by monitoring open, click-through, and response rates using email tracking tools. Examining these metrics will help you understand what strategies work best and where improvements are needed.

What are the best practices for following up on overdue invoices

Best practices include sending timely reminders, maintaining a polite tone, referencing previous communications, and providing clear instructions for payment. Following up consistently without being overly aggressive can help maintain a positive relationship with the debtor.

How can I ensure my debt collection emails are compliant with Australian laws?

To ensure compliance, familiarise yourself with the Australian Consumer Law and the Privacy Act. Avoid using misleading language and ensure that your emails respect the debtor’s privacy. Consulting with a legal expert in debt collection can also provide clarity.

What are some effective ways to handle debtors who are facing financial difficulties?

Effective strategies include offering flexible payment plans, discussing alternative arrangements, and showing empathy in your communications. Understanding their situation can foster goodwill and increase the likelihood of recovering at least part of the debt.

What are some creative subject lines that can increase email open rates

Creative subject lines might include “Let’s Settle Your Account Today” or “Quick Reminder: Your Invoice #[Invoice Number] is Due.” These lines should be clear, and immediate action should be encouraged while remaining professional.

How can I personalise debt collection emails to different cultural backgrounds?

Research cultural norms and communication styles to personalise emails for different cultural backgrounds. Use respectful language and avoid assumptions. Tailoring your approach can enhance rapport and improve response rates.

What are the key elements of an effective debt collection email?

An effective debt collection email should have a clear and concise subject line, a personalised greeting, specific details about the overdue invoice, available payment options, a strong call to action, and a professional closing. Incorporating these elements can significantly improve your chances of recovering outstanding debts.

How can I personalise my debt collection emails to increase response rates?

To personalise your debt collection emails, address the debtor by name, reference any previous communications or interactions, and tailor the content to their specific situation. Showing empathy and a willingness to work with the debtor can also help build trust and foster a positive relationship.

What are the best practices for writing a persuasive call to action in debt collection emails?

Best practices include being direct and clear about what action you want the debtor to take, providing multiple payment options, and creating a sense of urgency. A strong call to action can significantly increase the likelihood of prompt payment.

How can I effectively acknowledge previous communication in a debt collection email?

You can acknowledge previous communication by referencing specific details from past interactions, such as the date of the last conversation or any agreed-upon payment arrangements. This shows that you are attentive and value the debtor’s input.

What are some examples of empathetic language to use in debt collection emails?

Examples of empathetic language include phrases like “I understand that financial difficulties can arise” or “We are here to help you find a solution that works for both of us.” Using empathetic language can help build trust and encourage cooperation.

What are some examples of effective subject lines for debt collection emails?

Some examples of effective subject lines for debt collection emails include:

“Urgent: Overdue Invoice #[Invoice Number] – Immediate Payment Required”

“[Client Name], Kindly Settle Outstanding Invoice [Invoice Number]”

“Reminder: Payment Due for Invoice #[Invoice Number] – [Due Date]”

What are some best practices for following up on unanswered debt collection emails?

Best practices for following up on unanswered debt collection emails include:

- Setting up automated reminders to follow up within a specific timeframe

- Being persistent but respectful in your follow-up efforts

- Tracking email open rates and click-through rates to measure effectiveness

- Analysing responses to identify trends and areas for improvement

How can incorporating online payment options enhance my debt collection efforts?

Incorporating secure online payment links directly in your debt collection emails provides a convenient and efficient way for debtors to make payments. This can significantly improve your chances of recovering outstanding debts, as it removes barriers to payment and demonstrates your commitment to providing flexible options.

What should I do if a debtor is facing financial difficulties and unable to make a full payment?

If a debtor is facing financial difficulties, offer to discuss alternative payment arrangements or explore mutually beneficial solutions. Show empathy and a willingness to work with them to find a resolution. This approach can help maintain a positive relationship and increase the likelihood of recovering at least a portion of the outstanding debt.

How can I use storytelling to make debt collection emails more engaging?

Incorporating storytelling into your debt collection emails can create a more relatable and engaging narrative. Share a brief story about a previous client who faced similar challenges but successfully resolved their debt through communication and cooperation. This approach humanises the process and encourages the debtor to see the situation differently.

What are some tips for handling debtors who are unresponsive to emails?

If debtors are unresponsive, try varying your communication methods by following up with a phone call or sending a text message. Ensure your emails are clear and concise and consider offering flexible payment options. Additionally, create a sense of urgency by reminding them of potential late fees or consequences of continued non-payment.

How can I integrate video or multimedia elements into debt collection emails?

You can enhance your debt collection emails by including short videos or infographics explaining the payment process or outlining non-payment consequences. Ensure the multimedia elements are professional and relevant, as they can capture attention and clarify complex information more effectively than text alone.

What are the most effective times to send debt collection emails for maximum response?

The best times to send debt collection emails are typically mid-morning or early afternoon on weekdays, as these times tend to have higher open and response rates. Avoid sending emails late in the day or on weekends, as recipients may overlook them during busy periods.

How can I use humour appropriately in debt collection emails?

Using humour in debt collection emails can be effective if done tastefully and sparingly. Light-hearted language can ease tension but ensure it remains professional and does not undermine the seriousness of the situation. For example, a gentle joke about the “joys of paperwork” can lighten the mood while still encouraging prompt payment.

How can partnering with a professional debt collection agency like Bell Mercantile improve my debt recovery efforts?

By partnering with a professional debt collection agency like Bell Mercantile, you can leverage our expertise in crafting effective emails, persistently following up, and navigating the complexities of debt recovery in Australia. We can also provide guidance on legal compliance and help protect your business’s financial interests.