The Australian construction industry is grappling with unprecedented liquidations, highlighting the urgent need for effective debt recovery solutions. Recent data from the Australian Securities and Investments Commission (ASIC) reveals a troubling trend that threatens the stability and viability of businesses across the sector. As financial pressures mount, companies find themselves on the brink of insolvency, unable to cope with rising costs and payment delays.

In these challenging times, you need comprehensive debt recovery services to help your company navigate financial distress, recover outstanding debts, and stabilize its operations.

The Current State of Insolvencies

Between July 2023 and March 2024, a staggering 2,142 construction companies went into administration. According to ASIC data, this figure represents 27.7% of the 7,742 firms that became insolvent during this period. If this trend continues, Australia is on track to witness 10,000 company failures for the first time since 2012-13, marking a significant and alarming milestone in the country’s economic landscape. This surge in insolvencies is not just a statistic; it reflects businesses’ real and profound struggles in the construction sector, where financial stability is increasingly precarious.

Comparative Analysis

The current rate of insolvencies is alarmingly higher than in previous years. Insolvencies in the first nine months of 2023-24 were 36.2% higher than the corresponding months of 2022-23. This sharp increase underscores the growing financial pressures on businesses, particularly in the construction sector, where fluctuating material costs, labor shortages, and project delays exacerbate the situation. This trend signals deeper underlying issues within the industry, such as tight profit margins, cash flow problems, and delayed client payments, collectively contributing to a rising tide of financial instability.

Impact on the Construction Industry

Construction companies face unique challenges that contribute to their financial instability. High material costs, labor shortages, and project delays are just some obstacles that can lead to significant financial strain.

Additionally, the ripple effects of these liquidations are far-reaching, impacting suppliers, subcontractors, and the broader economy. The disruptions can lead to job losses, halted projects, and decreased investor confidence, further destabilizing the industry. These challenges are particularly acute for small and medium-sized enterprises (SMEs), as they often lack the financial buffers to absorb such shocks. The domino effect of one company’s failure can quickly spread throughout the supply chain, creating a cycle of financial distress and insolvency.

The Role of Debt Recovery in Mitigating Losses

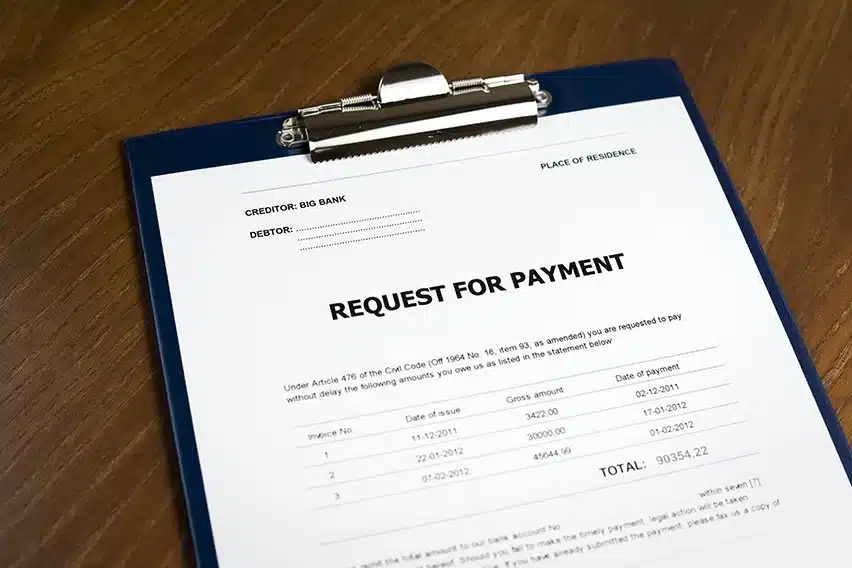

Effective debt recovery is crucial in preventing financial distress from escalating into insolvency. When businesses face unpaid debts, their cash flow suffers, quickly leading to financial instability and the risk of insolvency. Debt recovery services help companies recover outstanding debts promptly and efficiently, ensuring they maintain healthy cash flow and reduce financial strain.

With a proactive approach, you can ensure that debts are pursued immediately. This rapid response minimizes the impact of outstanding debts on the business’s financial health, allowing companies to stabilize their finances and focus on their core operations.

By partnering with a professional company, businesses can entrust the complexities of debt recovery to a team of experts, providing them with peace of mind and financial stability. This lets business owners and managers concentrate on growth and development, knowing their financial interests are robustly protected. Working with a skilled team will enable you to handle even the most complex debt recovery cases with ease, from local small businesses to large international corporations.

Conclusion

The increasing number of windups in the Australian construction industry underscores the importance of effective debt recovery. Choose a company with a proven track record and recover outstanding debts efficiently. With professional support, you can maintain cash flow, avoid insolvency, and stabilize your business operations. Their services are not just about recovering debts; they provide strategic support to distressed businesses.

Bell Mercantile’s Expertise and Services

With over three decades of experience, Bell Mercantile is a trusted name in debt recovery. The company specializes in domestic and international debt recovery, offering comprehensive services tailored to meet each client’s unique needs. Whether dealing with local businesses or navigating the complexities of international debt recovery, our team has the expertise to manage each case effectively.

We operate on a commission-based model, ensuring clients only pay for successful recoveries. This no-win, no-fee structure means there are no upfront costs or joining fees, making our services accessible and risk-free for businesses of all sizes. This approach aligns our incentives with our clients, ensuring our primary focus is achieving successful debt recoveries.

Our services are designed to be:

- Flexible

- Responsive

- Adapting to each client’s specific circumstances

Frequently Asked Questions

Debt recovery is the process of pursuing payments of debts owed by individuals or businesses. Bell Mercantile specialises in recovering these debts efficiently and effectively, ensuring businesses maintain healthy cash flow and avoid further financial complications.

Bell Mercantile operates on a commission-based model, meaning they only charge a commission on the amount recovered. There are no joining fees, making their services accessible and risk-free for businesses of all sizes.

Yes, Bell Mercantile specialises in domestic and international debt recovery, providing services tailored to the specific needs of each case. Their expertise and extensive network ensure successful recovery across borders, protecting your financial interests globally.

Bell Mercantile takes immediate action on files passed onto their Debt Recovery Agency, aiming to recover debts as quickly as possible to help businesses maintain cash flow and avoid further financial strain. The recovery speed depends on each case’s complexity, but their proactive approach ensures timely results.

Bell Mercantile has a 95% success rate in debt recovery without litigation, making it a reliable choice for businesses facing financial challenges. Their high success rate reflects their expertise, dedication and commitment to client satisfaction.